I’m closing in on the fun stuff – figuring out what you want from your new home. I started watching a ton of HGTV to see what kind of decision making was being presented… and for more on that, I point you to McSweeney’s List of Features of I Demand in a Home After Watching HGTV’s House Hunters.

With that in mind as you begin your search, maybe don’t watch too much HGTV. Except… I watched and still watch a ton of HGTV, and by the way if you know any Ottawa-area Bryan Baeumler-types who are on the market, holla at me, alright?

Anyway. Figuring out what you want.

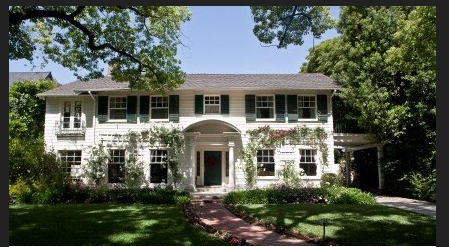

Father of The Bride

Location, Location, Location

This is the one thing that absolutely cannot be changed about a house; you can fix or change or learn to live with a lot of things, but the neighbourhood is not one of them. For me, I wanted to live downtown – but I knew that my budget would restrict me from that, so I opened my search to “as close to downtown as is reasonably affordable.” Maybe I couldn’t stumble home from the pub, but I wanted to be a cheap Uber-ride away.

To Condo, or Not To Condo

The condo question. There are a few things going on here. First, on the financial side of things – while the initial cost may be substantially cheaper (or may not be in some cases), you really need to consider your condo fees as part of the equation in terms of ongoing monthly expenses; if, say, you just shifted those fees into your mortgage payment instead, you’re likely to find that you can afford a lot more house. At the same time, the condo fees will include some of the maintenance on the home, so to really get an apples-to-apples comparison you need to estimate what it would cost for you to maintain the things that are part of the condo fee in a freehold.

Beyond finances, it’s a lifestyle question – based on the location, a condo might be the only realistic option. As well, in terms of benefits, many of the perks of being a tenant apply – it’s someone else’s job to worry about all kinds of maintenance and fixes. On the other hand, in a condo you may find you’re accountable financially for far more than you really and truly need. You may be paying to maintain a pool, a gym, employ on-site staff, not to mention the additional property and assets – like, say, roads and sewers – that you may be paying for with your condo. It adds up fast; and your condo fees certainly won’t cover everything – you’ll still have surprises, and you’ll still have things to maintain as a homeowner. I found, in some instances, condos that had fees that were as much as my mortgage payment would have been!

Some condos are managed very well, and some very poorly. I know people who live in really well-run condos, and they are very happy; I know people who live in not-so-well-run condos, and they are pissed. One thing I’ve noticed is that many people I know who have purchased condos end up getting on their condo board ASAP to ensure that they have some more control over how the condo is run; maybe you’re not super comfortable just leaving a lot of things up to your neighbours. Consider whether or not you’re going to be able to give up a certain level of autonomy in a condo – or are you going to forego all the benefits of the time you save by not mowing your lawn and shovelling your driveway because you’re now spending this time in board meetings?

It’s all about risk tolerance – am I more comfortable with the risk associated with allowing other people to have a vote on the maintenance and prioritization of things on my property, or am I more comfortable carrying the entire burden of maintenance and prioritization on my own? For me, it was the latter – so I entirely excluded condos from my search.

The Building

This is an area where many people have a vision. I did not at all. The building itself wasn’t a big driving factor for me – if I could theoretically live in an apartment that was not a condo, I’d have been open to that; I was open to townhomes, semi-detached homes and detached single-family homes. Bungalows, split-levels, and multi-storey homes. I prioritized location over building type – because if I worried too much about building type, what I wanted was that house from Father of The Bride, and I wanted it in Centertown, fully upgraded with quartz counters, gas range, spa-like bathrooms, a wine cellar, a butler, and a cheap mortgage. Alas. Knowing that what I wanted were the wants of a crazy person, the wants of someone who’s been watching too much HGTV, I was entirely flexible.

What am I willing to take on?

The last things I considered were my deal breakers. Not what did I want the house to have – number of rooms, number of baths, key features, etc. – but what could it absolutely not have? What was the work that might be needed that I was not willing to do? New roof? Heat source? Basement troubles? Looking in older, more established neighbourhoods meant looking at older homes. The budget was going to dictate how much of that older home may or may not have been upgraded since it was originally built.

I decided that I was willing to take on cosmetic issues – so what if I didn’t like some finishes and fixtures – but what it absolutely could not require was major electrical work, or foundation work of any kind. Unsurprisingly, of course, many of the homes I saw required either substantial electric or foundation work. Knowing up front what my deal breakers were helped me not to get too attached as I was looking at houses that might have seemed really great, but required more work than I would have the capacity – the finances or the knowledge – to take on.

In the next few posts, I’ll talk about actually conducting the search, some of the crazy and some of the awesome things I saw, and tapping into one of the best resources ever – FACEBOOK HIVE MIND!